Global Financial Crisis 2.0? Part 4

/

0 Comments

Should the government have intervened in Silicon Valley Bank?

Global Financial Crisis 2.0? Part 3

More on the Silicon Valley Bank Saga…The FDIC’s $522 Billion shortfall and shady dealings on Wall Street

Global Financial Crisis 2.0? Part 2

Chapter 2: Why government bonds are now a ticking time bomb

Global Financial Crisis 2.0?

Chapter 1: The Credit Collapse we’re about to see has been building to a head for a while now. Silicon Valley Bank was simply the first domino to fall

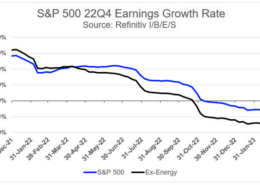

Earnings compression is upon us.

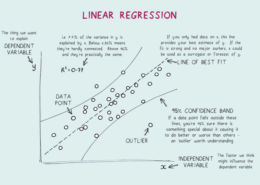

A surprising number of investors don’t understand mean reversion. Even if you do, keep reading. I promise you’ll find this fascinating.

You need to understand mean reversion during this market downturn

It’s funny: a surprising number of investors don’t understand mean reversion. Even if you do, keep reading. I promise you’ll find this fascinating.

A 3-day workweek? One Chick-fil-A proprietor is making it work like gangbusters

His program condenses a full 40-hour work week into just three consecutive days. It divides the staff into two rotating groups, called “pods,” that rotate between three-day blocks of 12- to 14-hour shifts.

Why The Pullback Of 10-Year US Treasuries Buyers Was A Problem For The Mortgage Market In 2022

The pullback of major buyers of 10-Year US Treasuries, such as the Fed and foreign governments, greatly impacted the mortgage market in 2022. This blog explores the reasons behind the pullback and its effects on bond yields, risk premiums, and mortgage rates.