The Key Metric Every Private Lender Should Know: “Effort-to-Return Ratio”

One of the most important pieces of advice I’ve EVER gotten is this…

“Investing is ALL about effort-to-return ratio.”

Every investor knows this to be true on some level. They may not be aware of it consciously, and they may not call it “effort-to-return.” But intuitively they understand…

You want to do the least amount of work (effort) while making the most money (return).

But it’s easier said than done. The real trick is finding a vehicle that actually checks those boxes. A vehicle that generates solid, double-digit returns in the most passive way possible.

My favorite vehicle — even during a down market — is private money lending.

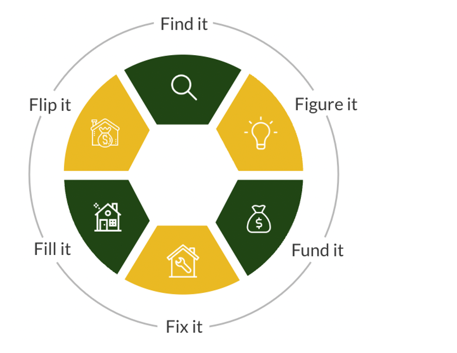

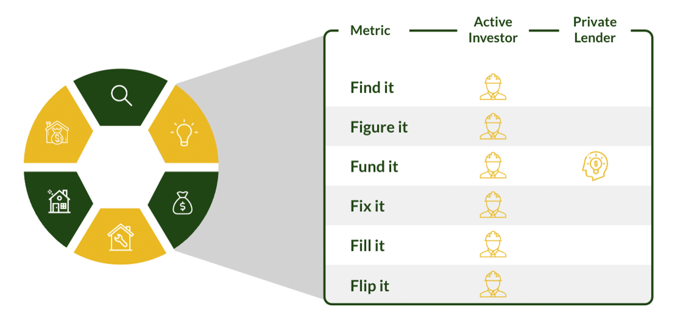

Here’s my rationale. See, there are 6 “Fs” in real estate investing:

In every real estate transaction…

- Someone has to FIND the deal.

- Someone has to FIGURE it by doing due diligence and running the numbers.

- Someone has to FUND it, either with their own cash or with a private loan.

- Someone has to FIX it up to make it sellable or rentable.

- Someone has to FILL it with a renter (assuming they’re buying to hold, or ultimately flipping it as a turnkey rental to a landlord buyer).

- Someone has to FLIP it to an end-buyer or no one makes any money.

If you’re an ACTIVE investor, aka a flipper, you have to do all 6. You literally make no money if you skip even one of the steps (with the possible exception of “filling it”).

Private lenders, on the other hand, only do ONE. They just have to FUND it, and then wait for the checks to roll in.

So what is private money lending? And how do you do it for maximum profit PASSIVELY, and thus achieve the best effort-to-return ratio?

Private (aka hard money) lending is simply another way of deploying capital in real estate. It involves making high-interest, short-term loans to house flippers…usually secured by the property they’re flipping.

And we have commercial banks to thank for it.

See, private lending as an investment vehicle only exists because commercial banks don’t like flip deals. They underwrite loans based on borrower credit score rather than project viability, and they don’t like lending short-term.

Private lenders take the opposite approach. We underwrite the deal first, then the market, then the borrower. In that order.

Which means the collateral (the property) is crucial. It’s the “asset” in asset-backed lending.

The goal in vetting the collateral is to understand three main things:

- What is the acquisition price of the property?

- What is the renovation budget?

- How much will the property sell for after it’s all fixed up? (called After-Repair-Value or ARV)

From there you can determine your Loan-to-Value (LTV) ratio with a simple calculation.

And if there’s one thing to focus on above all others in private money lending, it’s LTV. I think of it as the “golden ratio” that ensures you make maximum profit on your money with minimum risk.

Because the less risk you have, the more passive your investment experience. Couple that with above average double-digit returns, and you’re well on your way to maximizing your effort-to-return.

The LTV calculation is so easy a 5-year old could do it…

Step 1: You add the property’s acquisition price and renovation budget together

Step 2: You then divide by the After-Repair Value

Step 3: You multiply that number by 100 to make it a percentage.

Example:

$70k acquisition price + $10k renovation budget / $100k resale price = 0.8 * 100 = 80%

The LTV in this example is 80%. I told you it was simple!

OK, so that’s the math. The obvious next question is: what’s my target LTV percentage in a private lending deal?

The 80% we saw above is outside of my “credit box.” I stick to deals in the 60-70% range, and closer to 60% in the current market.

That’s my rule of thumb, anyway. I want my loan amount in a private lending deal to be at most 60-70% of the After-Repair Value (ARV).

Low Loan-to-Value ratios are one way you offset risk as a private lender. Another is to charge higher interest rates and origination fees.

See, by charging fees upfront, and double-digit annualized interest along the way, you’re ensuring that you’re getting above-average returns every month.

This keeps your effort-to-return ratio extremely high, which is one of the big things we’re solving for as a private lender. Or in any area of life, really.

Look, at the end of the day, what you do with your investable capital is up to you. I don’t have a dog in this hunt. But my suggestion: don't let your idle capital go to waste. Don’t let it get eaten away by inflation.

If you’ve got money sitting in your Self-Directed IRA or Solo 401K, or in a low-yield savings account, consider private lending. Your future net worth will thank you.

What Should You Do About What You Just Learned? Schedule a Call with Me.

If you’re an accredited investor and you’re dead serious about TRUE Financial Freedom…

…if you believe you can add a zero to your net worth and income over the next 5-7 years but not you're sure if you've got the right wealth strategy…

…and if you're serious about clawing back more time to spend with your family on things that truly give your life meaning…

…then schedule a call with me ASAP.

Leave a Reply

Want to join the discussion?Feel free to contribute!